Information contained in this news release is current as of the date of the press announcement, but may be subject to change without prior notice.

February 25, 2025

CTBC Bank Philippines Partners Hitachi Asia to Transform Digital Banking for Corporates and SMEs

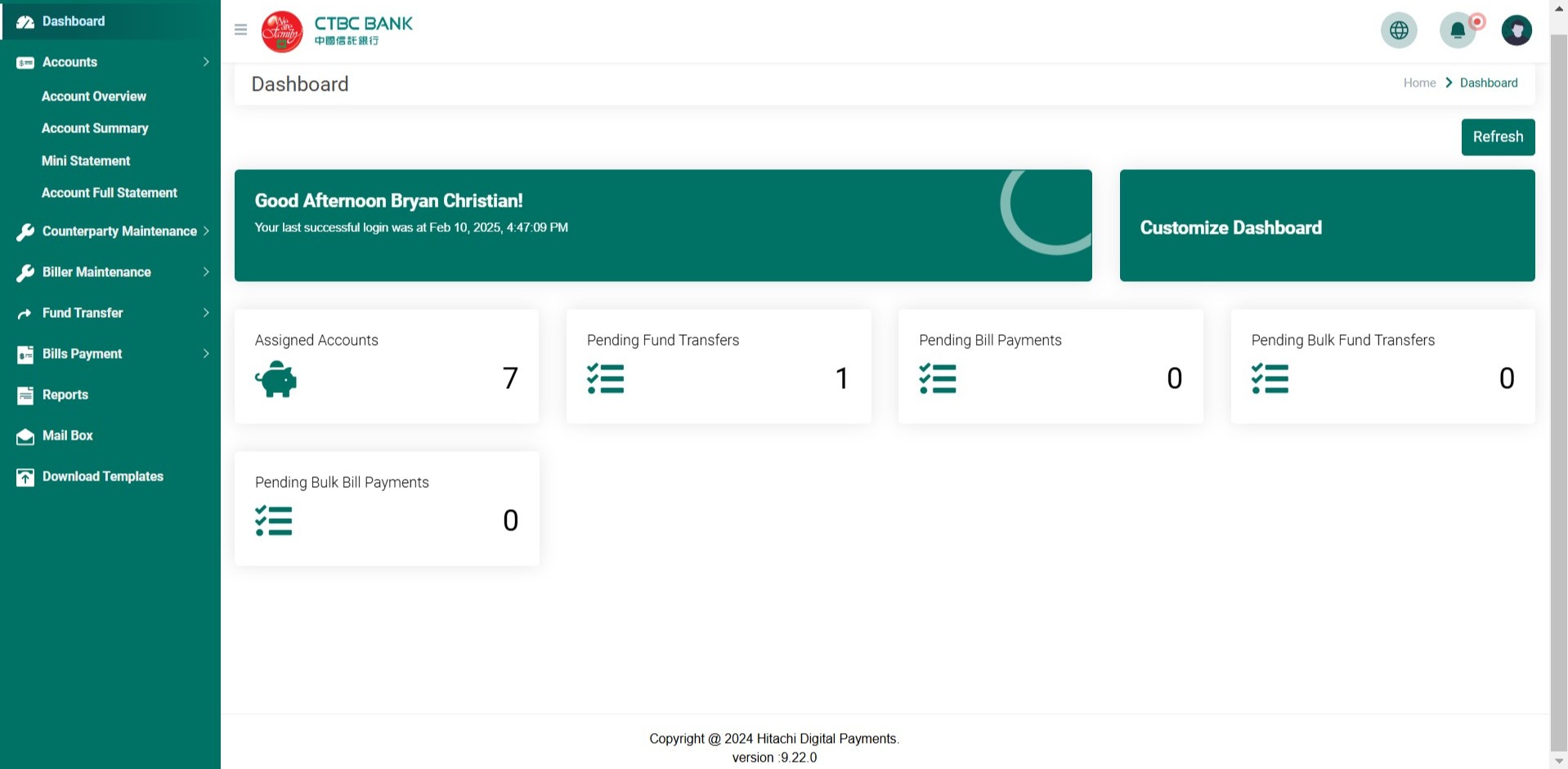

Singapore, 25 February 2025 – CTBC Bank (Philippines) Corp., in collaboration with Hitachi Asia, today unveiled its revamped Corporate NETBanking Web Portal. Building on the success of their previous partnership, which redesigned consumer-facing web interface and mobile banking applications, the two organisations are now extending their innovation to corporate banking. Empowering customers of all sizes – from Micro, Small and Medium Enterprises (MSMEs) to large enterprises – businesses can now streamline financial operations with an upgraded, secure and user-centric platform, thereby improving operational efficiency and meeting the evolving corporate banking requirements.

The 2023 Report on the Status of Digital Payments in the Philippines highlights a significant milestone for the Bangko Sentral ng Pilipinas (BSP), which surpassed its target under the BSP Digital Payments Transformation Roadmap 2020-2023 by increasing digital retail payments from 42.1% in 2022 to 52.8% in 2023. This latest collaboration between CTBC Bank Philippines and Hitachi Asia reinforces their continued commitment to accelerating digital transformation in financial services, making banking more accessible, affordable, and secure for businesses across the country.

The enhanced Corporate NETBanking Web Portal introduces a host of features that streamline financial operations, ensuring both efficiency and flexibility. Key functionalities include:

- Comprehensive Account Management: A unified platform that offers real-time access to deposit accounts, loan balances, and transaction histories, enabling businesses to make well-informed financial decisions.

- Comprehensive Payment Capabilities: Access to a wide range of payment channels for local and global transactions, including InstaPay, PESONet, BancNet IBFT, RTGS, PDDTS, and SWIFT, ensuring seamless payment processing for all business scales.

- Bulk Transaction Processing: Enhanced efficiency for corporate clients through bulk upload features for payments and payroll disbursements to significantly enhance operational productivity.

- Customisable Workflow and Approval Matrix: Flexible setups, ranging from basic single-approval workflows to complex multi-level matrices with transaction limits, provide businesses with the agility to adapt processes to their specific needs.

Security is a cornerstone of the Corporate NETBanking Web Portal, with features like two-factor authentication (2FA) ensuring robust protection against unauthorised access. Real-time notifications provide immediate updates on transactions, enhancing tracking and minimising fraud risks. Flexible approval workflows, such as Maker-Checker-Approver setups, further ensure compliance with corporate policies while adapting to specific organisational needs. Together, these measures create a secure and reliable foundation for businesses to confidently manage their financial activities.

“This new platform is more than a tool – it’s a strategic enabler for businesses to manage their finances with ease, efficiency, and confidence,” said Luis S. Elizaga, President and CEO of CTBC Bank Philippines. “Following the success of our retail app revamp, this collaboration with Hitachi Asia demonstrates our continued commitment to innovation, ensuring both our consumer and corporate clients have access to cutting-edge digital banking solutions.”

“In today’s financial landscape, ensuring secure and seamless access to banking services is non-negotiable,” said Lourdes Yap, Senior Director, Sales, Marketing and Business Development, Hitachi Asia Ltd. Philippines. “At Hitachi, we are committed to leveraging technology to enhance access to financial services and contribute to societal progress. Together with Hitachi Group of Companies – Megalink1 and Hitachi Digital Payment Solutions1, this partnership with CTBC Bank Philippines underscores our dedication to delivering innovative solutions that improve operational efficiency and safeguard financial data, enabling businesses to thrive in an ever-evolving market.”

*1 Megalink and Hitachi Digital Payment Solutions are subsidiaries of Hitachi Channel Solution Corporation in the Philippines. Hitachi Channel Solution Corporation is a leading vendor of cash recycling ATMs in the world. It also provides a suite of banking and digital commerce solutions.

About Hitachi Asia Ltd.

Hitachi Asia Ltd., (Hitachi Asia) a subsidiary of Hitachi, Ltd., is headquartered in Singapore. With offices across seven ASEAN countries Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand, and Vietnam – Hitachi Asia and Hitachi’s subsidiary companies offer IT, OT (Operational Technology) and products to support customers in their transformation journeys. We will contribute to the growth in the ASEAN region by co-creating with customers to identify the social challenges and needs and deliver the solutions. For more information on Hitachi Asia, please visit the company’s Social Innovation portal at https://www.hitachi.asia/.

About CTBC Bank (Philippines) Corp

CTBC Bank (Philippines) Corp. is a subsidiary of CTBC Bank, one of the 200 biggest banks in the world in terms of capital and the largest as well as the most awarded private banking institution in Taiwan. Opened as a full-service commercial bank in the latter part of 1995, the Philippine subsidiary actively provides financial services to both local and foreign companies in the country, aside from extensively serving the needs of the middle-income consumers. Its products and services include Peso Deposits, Foreign Currency Deposits, Card Payments, Consumer Loans, Credit Facilities & Corporate Loans, Cash Management Services, Treasury Services, Trust & Investment Services, Payment & Remittance Services, Trade Services, Retail and Corporate online banking, among others.

To date, CTBC Bank (Philippines) Corp. has one of the largest branch networks among foreign banks in the country. It is also deemed to be one of the most successful among many commercial banks that opened in the same year. For more information about the Bank, please visit www.ctbcbank.com.ph.